Funding

It is important to choose a method of vehicle funding that will suit your situation. Requirements vary from client to client so we recommend you look at some of the factors listed below and see which are relevant to you. No one funding method can suit the needs of all clients, which is why we offer a variety of products which we tailor, to suit you;

- Monthly Budget?

- Personal or Company Purchase?

- Current Expected Annual Mileage?

- Is Vehicle Ownership Required?

- Can VAT be recovered?

- Tax Situation.

- Maintenance or Servicing required?

- On or Off balance sheet funding required?

- Do you want the responsibility of Disposal?

- Fixed payments or Outright Purchase?

See below which method would suit your requirements;

- Contract Hire

- Personal Contract Purchase

- Contract Purchase

- Finance Lease

- Lease Purchase

- Hire Purchase

Contract Hire

Contract Hire is a method of funding which is popular amongst companies looking to remove assets from their balance sheets and eliminates the financial risk that can be associated with disposing of their vehicles. Contract Hire is arranged over a fixed period of months (term) and number of payments with previously agreed mileage stipulations.

Contract Hire payments are calculated based on:

- Vehicle Price

- Length of term/contract.

- Agreed annual mileage.

- Road Fund Licence costs.

- Depreciation.

- Interest Charges.

- Maintenance charges-if this option has been selected.

The fixed running costs of Contract Hire leads to simple Monthly Budgeting.

Note: You do not have legal ownership of the vehicle and you have the responsibility for insuring the vehicle with a fully comprehensive policy.

Tax relief on a contract Hire vehicle is calculated according to the vehicles Co2 output. Contract Hire allows VAT registered companies to reclaim 100% of the VAT on the rental if the vehicle is solely for business use or up to 50% of the VAT for mixed use. If the client has chosen the maintenance option then 100% of the VAT on the servicing element of the rental cost can be reclaimed.

*PAC Solutions can provide a service to their customers whereby the vehicle(s) are inspected prior to being returned to the finance company for damage assessment. Any repairs needed can be organised by PAC Solutions. Should you choose then not to have the vehicle repaired, PAC Solutions can agree a final repair bill with the finance house on your behalf.

Personal Contract Purchase (PCP)

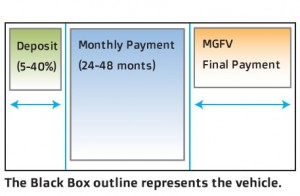

PCP involves an initial deposit and then a series of fixed monthly payments followed by a balloon payment referred to as the Minimum Guaranteed Future Value (MGFV) which is worked out by the funders based on the individuals annual mileage. The monthly payments are the cost of the vehicle after the MGFV and the value of your deposit have been deducted. see diagram below.

At the end of the term the individual has the option to purchase the vehicle, by paying the final balloon payment (MGFV) or hand the car back to the funder. In a lot of cases the car can be used towards the deposit on their next car should the car value exceed the minimum future value set.

This is a great option for people opting out of their company car schemes. Most agreements can be started with a small initial deposit and monthly payments are then fixed for the total term. With a Personal Contract Purchase the monthly finance payments are not subject to VAT.

Contract Purchase

Contract Purchase is a finance agreement for companies who want to own their vehicles, but want to avoid the risk of depreciating assets. With a Contract Purchase agreement the monthly finance payments are not subject to VAT. If an optional service package is taken, VAT is then payable on the service costs.

The company hires the vehicle from a provider for a specified term and makes fixed monthly payments to hire it. At the end of the contract, the company or driver has the option to purchase the vehicle for a predetermined amount, this is also known as a final balloon payment (FBP), as long as the terms of the agreement have been completed.

Tax relief is not restricted in the way a vehicle on a lease or Contract Hire is, however there is no way to reclaim the VAT unless the vehicle is used solely as a pool car. This would mean that the vehicle could only be used for business with no private use allowed.

Finance Lease

Finance Lease is most suitable for businesses where reclaiming VAT is not required and is usually arranged over a fixed period, this is popular with business users and commercial vehicles when Contract Hire is not suitable. On a Finance Lease agreement, you can choose to pay either the entire cost of the vehicle including interest charges over an agreed lease period, or opt to pay a lower monthly rental with a final payment based on the anticipated resale value of the vehicle. The Funder remains the vehicle owner so is able to claim any available write down allowances and this is reflected in the monthly payments. VAT is payable on the rentals and not the purchase price while usually payments can be offset against taxable profit (special rules apply for cars).

At the end of this commercial lease agreement the vehicle will be sold to a third party and you will receive the major share of the proceeds once the final payment has been settled (if applicable).

Finance Lease is not available to Private Individuals but is a preferred option for Businesses due to the significant tax advantages.

Lease Purchase

Lease Purchase is an agreement designed to offer dedicated vehicle funding where the customer wishes to purchase the vehicle. The vehicle can be kept as a business asset and you can discount the cost over a longer period of time.

The customer is liable for the full value of the vehicle and has no option to return it at the end of the agreement. Monthly payments are not subject to VAT.

Hire Purchase

Hire Purchase (HP) is the traditional way to finance a car purchase. You pay off the entire price of the vehicle through a series of monthly payments. At the end of the contract period the vehicle becomes your property.

The monthly payment is determined by the amount of deposit paid, interest charges, the period of the contract and the sale price of the vehicle. Terms are available from 12-60 months with very competitive rates available. Hire purchase is a good funding method in its flexibility as you are able to settle the outstanding balance at anytime without incurring large penalty fees.

HP is very similar to having a loan from a bank and paying it back over a fixed period of time with interest. However hire purchase is a secured loan which will be secured against the vehicle and not your personal assets.